There may be instances where different accountants or companies might make different judgments, leading to subjectivity in the application of the principle.

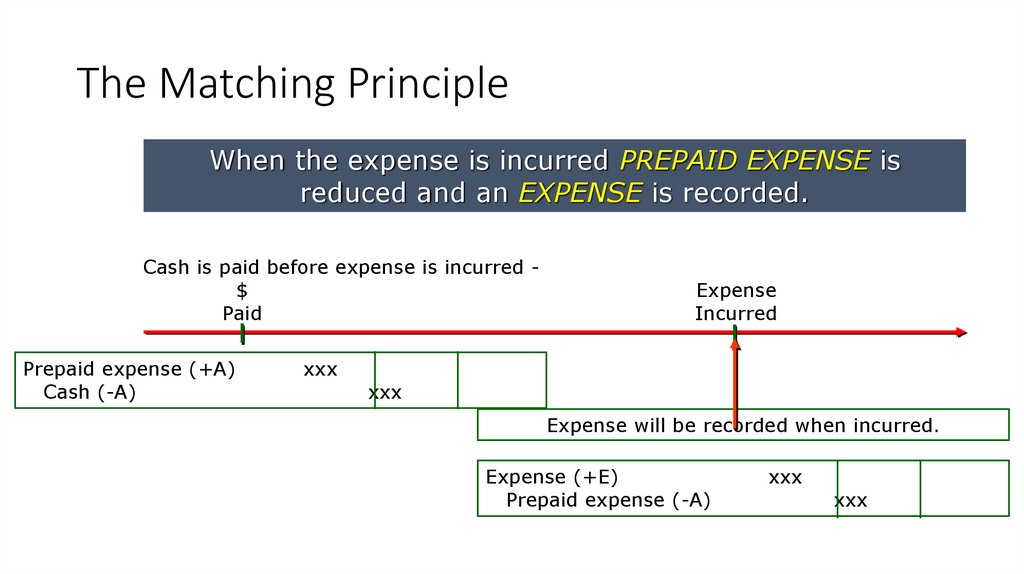

This means that expenses associated with generating revenue must be recognized at the same time as the revenue, in order to accurately reflect the true cost of generating revenue. The matching principle is closely connected to the revenue recognition principle because it requires that expenses be recognized when they are incurred, and not when they are paid. The matching principle, on the other hand, when applied to revenue recognition, requires the expenses associated with generating that revenue to be recognized at the same time as the revenue. According to this principle, revenue should be recognized when it is earned, and not when it is received. The revenue recognition principle is another important concept that governs when, and how, a company can recognize revenue. The matching principle is important for making financial statements comparable across different periods and aiding stakeholders in analysis and decision-making.

This means that expenses should be recognized when they are incurred, regardless of when the cash payment is made.įor example, if a company sells products in May but the associated manufacturing costs are incurred in April, the matching principle requires that the expenses be recognized in April when they were incurred, not in May when the company collected revenues. It is to ensure that expenses are appropriately linked to the revenues they generate to avoid any misrepresentation of financial results. The matching principle states that, to accurately reflect the relationship between them and how they affect each other, both revenues and their corresponding expenses should be recorded in the same accounting period. This principle is a key part of accrual accounting and aims to give a more precise picture of a company’s financial performance. The matching principle is an important accounting concept that requires expenses to be recorded in the same period as the revenues to which they contribute.

0 kommentar(er)

0 kommentar(er)